Nonresponse Bias: The Hidden Threat to Your NPS, CSAT, and Customer Reviews

If you are a founder, product manager, or marketer tracking NPS or CSAT, you already know the power of customer feedback.

But here’s the uncomfortable truth: your survey results might be lying to you.

That is not because customers are dishonest. It is due to nonresponse bias, a subtle yet powerful distortion that creeps into every feedback system.

What Is Nonresponse Bias?

Nonresponse bias occurs when certain groups of customers do not respond to your surveys, and their absence changes your results.

Let’s say you send your NPS survey to 1,000 users and get 100 responses. If most respondents are your loyal customers, your NPS looks great, but it does not represent the full picture.

The silent 900 might be neutral, disengaged, or unhappy, and their silence skews your understanding of overall satisfaction.

This is not just about missing data. It is about systematic bias, where the people who do not respond are meaningfully different from those who do.

Why Nonresponse Bias Happens (and It Is Not Always Your Fault)

Nonresponse bias can happen for several reasons. Many have little to do with the quality of your product and everything to do with how, when, and to whom you send surveys.

Here are the most common causes:

- Survey fatigue – Customers are tired of being asked for feedback too often.

- Poor timing – You ask for feedback when it is irrelevant or intrusive.

- Long or unclear surveys – If it takes more than a minute or two, people drop off.

- Wrong channel – You send email surveys to users who primarily engage in-app or via chat.

- Failed delivery – The survey never actually reaches people due to spam filters, inactive addresses, or old contact lists.

- Lack of personalization or relevance – The survey feels generic or automated.

- Low trust – Customers doubt whether their feedback will make a difference.

The last one, failed delivery, is more common than teams realize.

If half your “nonrespondents” never even received your survey, you are not just dealing with low participation. You are dealing with false visibility. It looks like users ignored you when, in reality, the message never landed.

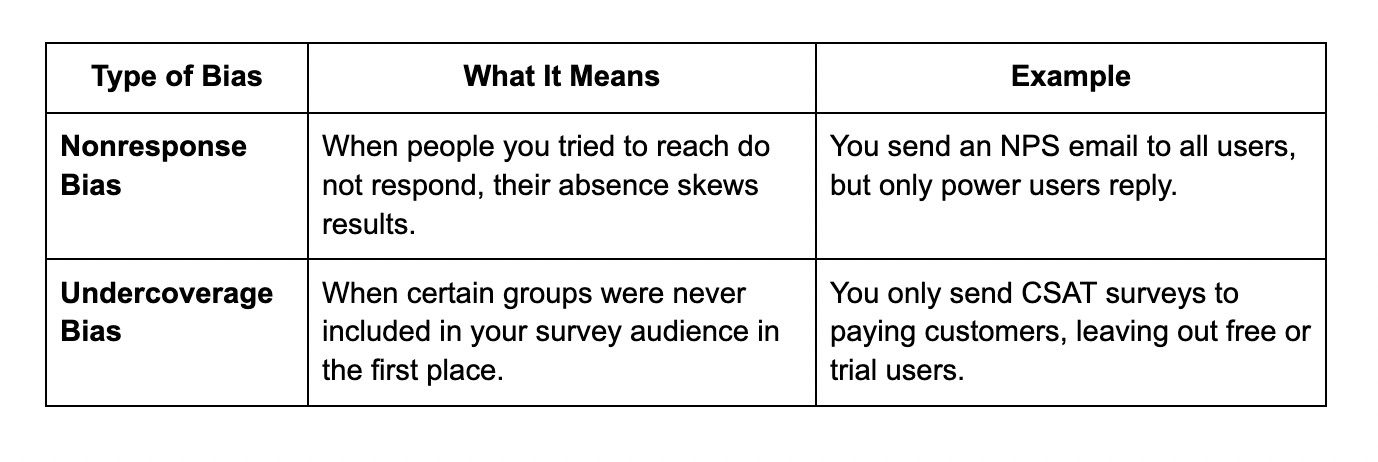

Nonresponse Bias vs. Undercoverage Bias

It is easy to confuse nonresponse bias with undercoverage bias, but they are not the same thing.

Both create misleading insights, one because people do not answer, the other because they were never asked.

Understanding both helps ensure your feedback is truly representative.

Why Nonresponse Bias Is a Big Problem for NPS and CSAT

When your survey data represents only a small or self-selecting group, every downstream metric, including NPS, CSAT, and CES, gets distorted.

Here’s how it shows up:

- Inflated NPS – Only happy or loyal users respond, making your brand look stronger than it is.

- Misleading CSAT trends – Dissatisfied users drop off and stop responding, so scores appear stable even when experience worsens.

- Unreliable product signals – You build for vocal users instead of the silent majority.

For a team that values data-driven decisions, that is dangerous. It means you are optimizing based on partial truths.

How to Reduce Nonresponse Bias

You cannot eliminate nonresponse bias completely, but you can reduce it dramatically by redesigning how and when you collect feedback.

Here’s what works:

1. Make Surveys Contextual (Event-Based Triggers)

The single biggest improvement you can make is to trigger surveys based on user behavior, not static timelines.

Send your NPS or CSAT survey after a meaningful event, such as completing onboarding, resolving a support ticket, or finishing a purchase.

Event-based triggers increase relevance, and relevance drives response rates.

When users see that your survey is tied to a real moment in their journey, they are far more likely to respond.

2. Keep Surveys Short and Focused

One or two questions are enough.

No fluff or extra data fields. A clean NPS question with an optional comment box is all you need.

Short surveys reduce fatigue and make completion feel effortless.

3. Use the Right Channel

If your users spend their time in Slack or Intercom, do not rely on email.

In-app surveys and chat-based prompts often outperform traditional email surveys.

The goal is to meet users where they are, not where it is convenient for you.

4. Track and Compare Response Rates

Measure your response rate by segment, plan, and geography.

If SMB customers respond 40 percent of the time but the enterprise customers only 10 percent, you have a bias problem.

Treat response rate as a key metric, not an afterthought.

5. Ensure Survey Delivery and Accessibility

Before sending a large batch, test your invites. Check subject lines, mobile rendering, and spam deliverability.

A survey that does not load properly or ends up in junk mail contributes to nonresponse before it even begins.

6. Close the Feedback Loop

Customers are more likely to respond when they believe their feedback is heard.

Even a short “We made this change based on your feedback” message can increase engagement over time.

How Opin Helps You Capture More Representative Feedback

Opin is built to help teams avoid blind spots in their feedback loops.

- Event-based triggers ensure surveys are sent at relevant, natural touchpoints, not arbitrary times.

- Response analytics show exactly who is responding and who is not, helping you catch bias early.

- Omnichannel delivery means your surveys reach users through email, chat, or in-app, wherever they are most active.

Opin gives you confidence that your NPS or CSAT truly reflects your customer base, not just your most enthusiastic supporters.

Final Thoughts

Nonresponse bias is not always obvious.

You can have a high NPS, a polished dashboard, and a confident presentation, and still be seeing a distorted version of reality.

The real question to ask is not just “What’s our NPS?”

It is “Who did not respond, and what would they have said?”

With the right survey design, delivery, and timing, you can close that gap and finally get a feedback system that represents everyone.

If you are ready to make your feedback more representative and reliable, learn how Opin helps teams design smarter, bias-resistant surveys.